Blog

I recently hosted a roundtable on marketing measurement with my wonderful colleagues Jen Ross (CMO, Intentsify) and Alisa Groocock (Former VP, Principal Analyst, Demand and ABM at Forrester). I found myself walking away from that session with my own thinking evolving in terms of how to move forward in demand and ABM measurement.

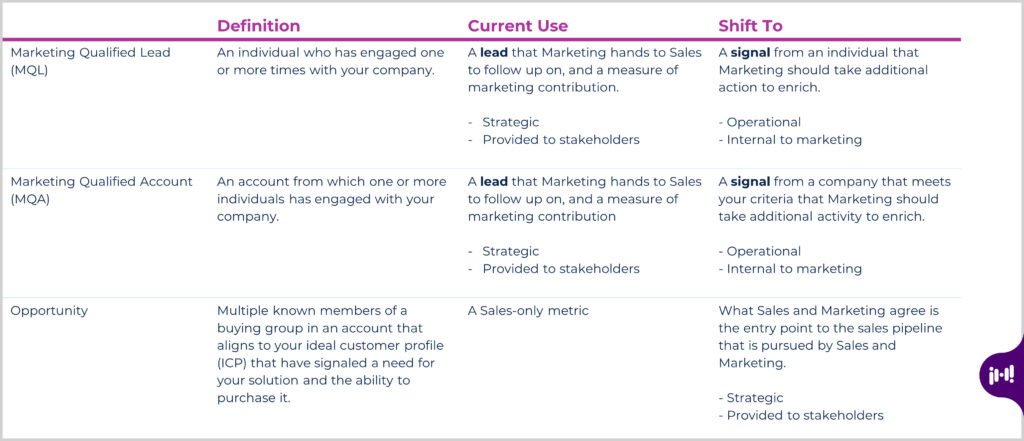

A lot has been written about the need to move past marketing qualified leads (MQLs) as the pillar of marketing measurement. Alisa made a compelling argument about the shortcomings of MQLs given that they only indicate that an individual has engaged with your company. That is useful, but incomplete. The same holds true for marketing qualified accounts (MQAs)—gathering signals that a company (account) has had instances of engagement is also useful, but incomplete.

In our webinar poll, most attendees indicated that MQLs were not working for them and many also found fault in MQAs. So, with an increased belief that demand and ABM measurement must evolve, and an increasing understanding of where to go—what is the problem and why are things moving so slowly?

To evolve marketing measurement, we need to redefine MQLs and MQAs as inputs rather than outcomes.

Marketing organizations have been using MQLs as the measurement of marketing contribution since the late 1990s. The promise of the MQL was the ability to prove that marketing activity has a direct impact on revenue. Most senior marketing leaders and their stakeholders have had a deep and long relationship with MQLs. It’s terribly difficult to tell those same stakeholders that MQLs are a failed experiment (and I can imagine a few sales leaders with “I told you so” in their minds … or on their lips).

But are they? MQLs are still useful marketing measurements, but without the same expectations as before. MQLs indicate an individual has engaged with your company by opening, clicking, attending, or stopping by. That’s good information, but it’s not an outcome. Rather, it should be thought of as an input. The same can be said for MQAs.

With this shift in thinking, MQLs become a lead for Marketing to develop, rather than a lead for Sales to run after. By building on that individual’s signal(s) and discovering the context, determining the buying center, and filling out the buying group and solution area or category of interest, Marketing can provide Sales with an opportunity, saving Sales the time and effort of pursuing leads that aren’t a good match.

Making the shift: Condition and transition your stakeholders over time.

Suddenly removing such a well-known metric from your reporting would likely cause CXOs and Board members to suspect you’re trying to hide something. A better play is to add new metrics and attributes and then slowly shed the metrics that are for marketing operational purposes from stakeholder reporting.

You might do this in four stages, like this:

1. Introduce the idea.

First, start a conversation with your stakeholders in Marketing, Sales, C-suite, and Board about how you will be evolving your demand measurement to provide higher quality opportunities to Sales. Make sure to use the metric language you will eventually stick with (e.g. opportunities, MQO). This step is to gauge how receptive they will be to the move. Remember, you are selling a better mouse trap and they will never buy it if they don’t believe they have a mouse problem.

You may have a very warm reception, questions on why, or even a split reaction. One marketing ops leader I talked to found that Sales was on board immediately, but other marketers were resistant. Be prepared to “show them the mice”—the shortcomings of MQLs—if needed and provide a rough idea of how measuring opportunities will improve upon them.

2. Add a second dimension to your MQL reporting.

It’s best to ease into this to give stakeholders time to adjust to the new information, and Marketing time to get solid with any process changes. For example, you might start showing how many of your “leads” are individuals in companies that meet your firmographic targets. This way you can say, for example, that you generated 100 leads (individuals that showed interest) and 95 of them are in companies that meet your target account list or profile.

3. Add ICP attributes.

After a couple of reporting cycles, add one or more nuanced ICP attributes to further qualify the opportunity. For example, I once worked for a company where we wanted to know how many servers a company had. Large server farms were the best opportunities, but the size of the server farm (ICP attribute) wasn’t always directly correlated to the size of the company (firmographic attribute). It was something I needed to figure out for each possible target account. Adding this detail in helps narrow the list of leads to those who are more likely a match.

Extending our example above, with the addition of these attributes, you can now say: “Marketing generated 100 individuals that showed interest, 95 of them were in the right accounts from a firmographic standpoint, and 80 of them met the key ICP attribute, ‘has a large server farm.’”

It’s critical to make it clear that Marketing just saved a pile of company resources by not handing over the 15 “leads” that were not really a match. Sending them to Sales would have led to frustration and wasted time. Yes, there are fewer “leads,” but they are higher probability. You’re welcome.

4. Add buying group information.

When your stakeholders are comfortable, and you are able, add the next dimension. This will likely be around the number and roles of buying group members. This is going to be different for each company and will take some discovery. Two examples to illustrate:

- I recently had a conversation with a vendor who had found a substantially higher close rate when three or more contacts were attached to the opportunity. Therefore, they focused on capturing all the contacts in a company and attaching them to an opportunity.

- Another company found that 100% of their deals ended up having the VP of Infrastructure (or equivalent title from IT) involved, even though the champion buyer was in sales. That is stark! Because a deal would not close without that buying group member, Marketing worked to bring that role into the conversation earlier and was often able to pass their name and engagement activity to Sales as part of the opportunity.

With this addition, your reporting may look like: “We generated interest in 95 companies that meet our target company dimensions. Of those, 80 have big server farms, and for 65 we have 3 relevant contacts.”

Make it clear that you just saved a pile of time and resources by not handing over those 30 “leads” that were not ready or a match. Sending them to Sales would have led to frustration and wasted time. Yes, there are fewer “leads,” but they are higher probability. You’re welcome. (Yes, that was intentional, part of change management is consistent repetition.)

When is the right time to start evolving your marketing measurement?

It’s pretty clear that you can’t decide to move from MQLs to Opportunities one month and expect to have that done the next. In fact, to get fully transitioned could be a year-long effort. In our webinar, Jen noted that “as a CMO, this is just one of the things I’m working on,” which begs the question—how do you prioritize this effort against all the other efforts you might have on your plate?

- Find another impending event to drive timing. In Jen’s case there were system changes that were driving a revision of reporting, and it made sense for this change to be part and parcel of the whole. Other catalysts may be a change at the C-suite or board level who do not have a history of earlier measurement approaches. Mergers and acquisitions or other business or go-to-market changes could also be drivers. A new business unit may be a place to sandbox or prototype a new approach.

- Weigh the benefits vs. other projects. As I’ve outlined, the key benefits of moving to opportunity-based measurement include less wasted effort and fewer missed opportunities. But you should also consider the time and energy you might regain by eliminating the debating, defending, and trying to “get credit” for leads that is often the biggest source of tension between sales and marketing. If your agenda includes optimizing resources and focus, a measurement restructuring will offer a high ROI.

The Iron Horse insight.

Shifting the mindset and getting all of Marketing and stakeholders comfortable will be gradual. That’s okay. Chances are there are processes, capabilities or technology changes that must happen also, and those will take some time, too. Perhaps you’ll need a new “opportunity object” in your CRM. You might need some reverse engineering to really understand your ICP and buying groups. Maybe some training or new scripts for BDRs are in order. Look for inspiration to others that are on the journey, and partners that can guide your change management alongside the process changes.

Subscribe to our blog.

Get unstuck with the most interesting business ideas and our insights delivered to your inbox.