WEBINAR: Transitioning from CMO to CRO: Insights from the Front Lines.

Drive growth with an integrated event marketing strategy.

Incorporate your webinars and hybrid events in your larger marketing strategy.

Where do you need help with virtual/hybrid events and webinars?

Our approach.

At their core, events—whether virtual or hybrid, single webinar or full day—are large digital marketing campaigns. Pulling this off depends on having platforms that deliver the capabilities you want, and designing an end-to-end experience that delivers optimal engagement for attendees.

No matter the final event format, today’s attendees discover, learn about and register for events online. Our integrated approach to event marketing leverages the versatility, trackability and cost-effectiveness of digital to reach and engage audiences before, during, and after events.

We draw on our relationships with platform vendors across the virtual and hybrid event ecosystem and our digital marketing and event demand gen domain to help you plan and market premium experiences that delight your audience and grow your business.

PLANNING & STRATEGY

Get strategic about your virtual and hybrid event portfolio.

It’s easy to get caught up in the logistics of a hybrid event or webinar. Before diving into your long list of to-dos, take the time to plan—and plan well. Establishing the foundations for your program, aligning on goals and success metrics, and anticipating the needs of your attendees are just a few critical ways to begin plotting your way to event nirvana.

We help you take a holistic view of your webinar and hybrid event portfolio and work with you to design an integrated program that accelerates opportunities with target accounts and delights attendees.

OUR PLANNING & STRATEGY SERVICES INCLUDE:

- Event Strategy Review

- Attendee Journey Mapping

- Platform Research & Evaluation

- Audience Segmentation & Analysis

- Establishment Of Success Metrics

- Value Proposition & Competitive Positioning

EVENT PROMOTION

Get attendees to register

—and show up.

There’s a whole host of challenges to hybrid event and webinar marketing. You have to identify the contacts and accounts you want to attend. You have to break through the noise to get their attention. You have to convince them of the value of showing up and engaging on the day of the event. After the event, you’ll want to follow-up and re-engage to avoid deadends in their journey.

We facilitate all of this—with years of experience in demand gen at our backs. We take an audience-centric perspective on virtual and hybrid event marketing, so your audiences will notice and respond.

OUR EVENT PROMOTION SERVICES INCLUDE:

- Content Development

- Pre-, During And Post-event Nurture

- Paid Media

- Speaker & Sponsor Promotion Kits

- Sales Resources & Competition

WEBSITE DESIGN & CREATION

Invite prospects to a website worthy of your event or webinar.

Virtual and hybrid events and webinars are often a prospect’s first introduction to your brand, making your event website or webinar landing page a unique opportunity to make a first impression and set the tone for the entire experience.

With our customer experience (CX) expertise, technical chops, and webinar and event platform partner network, we’ll help you showcase your brand’s identity and value with an attractive, custom-designed site—one you simply cannot achieve with an out-of-the-box site builder.

OUR WEBSITE DESIGN & CREATION SERVICES INCLUDE:

- Registration Planning

- Fully-branded, custom designed websites

- Website Development

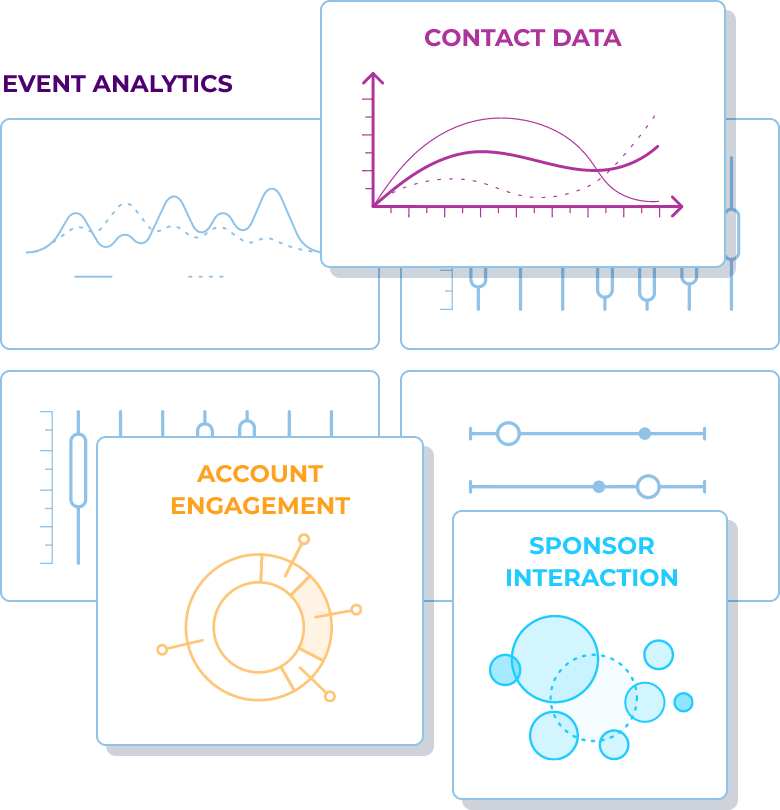

ANALYTICS & INSIGHTS

Enhance future campaigns with actionable event insights.

Events are a treasure trove of data about your customers and prospects. With every action we track, organizers get access to rich attendee engagement data that can be shared with sales teams, sponsors and partners and used to fuel decision-making and optimize campaigns.

Gain insight into the needs and interests of your ICP to build a more complete profile. Understand the success of your event—what worked and what didn’t—to create more tailored experiences for your next event. And, roll everything right into your marketing automation or CRM system, giving sales more context for in-pipeline opportunities and new ones. We help you sift through this wealth of data to surface and use the analytics that matter most to your business.

OUR analytics & insights services include:

- Virtual Event And Webinar Performance KPI Dashboards

- Prospect & Account Engagement Insights

- Data Integration With Map & Crm Systems